This year, production continues to suffer the consequences of the poor weather conditions of 2023, with yields reduced by up to 20%.

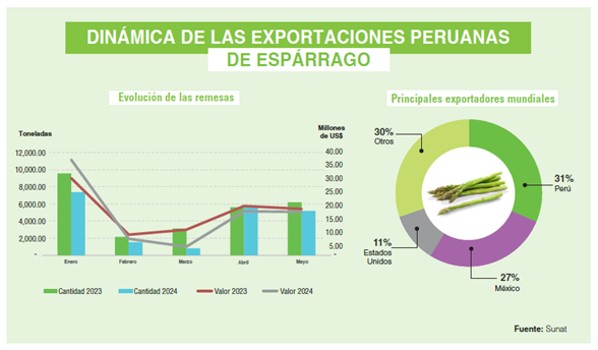

Peru exported 20,648 tons of asparagus for US$ 81 million so far in 2024: a 22% drop in volume and 5% in value.

The price of the vegetable was able to sustain the sharp reduction in volume, trading at an average of US$3.92 per kilogram, 22% higher than the previous year.

Consumption trends in major global markets have been moving towards healthier eating. This favours products such as asparagus, whose demand growth projection has been positive in recent years. And while this should be a good incentive for producers, for Peruvian exporters the road has been full of obstacles. After a period of strong growth and attractive prices, production and commercial problems have become persistent.

2022 was a difficult year in terms of trade. Prices remained at a low level and international competition grew considerably. It was much more difficult to place the recovered Peruvian production in the North American and European markets. On the other hand, in 2023, the situation was the opposite. The El Niño phenomenon greatly limited the world supply, including the Peruvian one, and this generated a significant increase in prices that allowed the year to close positively for Peruvian asparagus producers.

However, the danger posed by Mexican production, which has easy access to the North American market, is constant. Especially when its production is on the rise. China is the main world producer, but it does not usually export as much volume as Peru or Mexico, the global leaders, given its high internal demand. However, on occasions of large production, China has the capacity to flood the large international markets for significant periods.

In 2024, Peruvian production is still suffering the consequences of last year’s poor conditions, with yields per hectare down by up to 20%. Added to this is the departure of many producers of this crop, after the difficult years that the product has suffered since 2018. Thus, so far this year, shipments totaled 20,648 tons worth US$ 81 million, which meant a drop of -22% in volume and -5% in value. The price was able to sustain the sharp reduction in volume by trading on average at US$ 3.92 per kilogram, 22% higher than the previous year.

Initial projections indicate that the year would close at a similar level, but there would be a slight improvement as the end of the year approaches. Therefore, in a scenario of climatic regularization and a correct development of demand, according to Fresh Fruit’s projections, asparagus exports for the whole of 2024 would register a drop of 18% in volume and 4% in value.

Importing dynamics

The United States is the main global buyer of asparagus and its main supplier is Mexico. However, Peru maintains an influential position in this market. Demand remains stable with slight fluctuations and the value given to Peruvian asparagus remains slightly higher than that of Mexican asparagus, and this is reflected in the average price received, which stood at US$3.52, 20% higher than the previous year. This could offset the drop of almost 21% in the volume of Peruvian shipments. This situation could continue for some time with the limited domestic supply and with Mexico still having problems taking off.

Shipments to Europe were much more affected. Demand remains robust, but volumes, both imported and domestic, have not been sufficient, which has generated strong upward pressure on the price. This averaged US$5.24 per kilogram, 31% higher than the previous year. However, the available volumes were much lower, with a drop of around 33%. It is expected that the stock situation will improve as the year progresses. Other producers, such as Greece and Italy, are obtaining opportunities to make their production stand out more and be able to catch up with the competition, so the Peruvian producer should not only worry about meeting the demand for volume, but also about producing a competitive quality.

Fuente agraria.pe

Chile

Chile